By Oliver King, CEO Avinode Group

Back in the 90s, I worked for British Airways, and my American boss had an expression – “It’s OK to look back; just don’t stare.” He administered this advice when he thought the past had little to inform future decisions. In 2022, I reached for his expression.

I started in business aviation back in 2011. The preceding financial crisis of 2008/09 saw the curtailment of the fleet and activity, driven by new aircraft deliveries and cheap money. That ended, and it took several years to absorb the surplus with, ironically, new demand from Russia playing a role in the eventual recovery. This period was characterized by predictable, steady growth.

2020 – and the world changes over night

Abrupt does not do justice to the momentous events we are experiencing. Let’s pause for a moment. The first global pandemic in 100 years severely curtailed travel and economic activity and had an unimaginable impact on lives across the globe. We then saw the sharpest demand expansion for business aviation in a generation, a 40% increase, driven by demand for services and significant degradation of the global commercial airline network.

As economics recovered, a worldwide supply crisis ensued. Only to see the Ukraine invasion by Russia trigger a humanitarian crisis on the doorstep of Europe and prompt a global energy crisis that remains unresolved.

Economic shocks have stoked inflation and required central banks to intervene and raise interest rates.

So, when I was asked to summarize my reflections on 2022 and the road forward, it was difficult to know where to start.

Let’s start with demand. I agree with the voices in the industry arguing that a fundamental step change in demand has occurred over the last two years. Yes, demand in Europe has weakened this fall, as it does each winter, given the seasonal nature of leisure demand. It is not a reversal but a return to “normal” patterns, albeit at a high point. Similarly, the US has weakened but remains considerably up. The good news is that many of those new end-clients are staying.

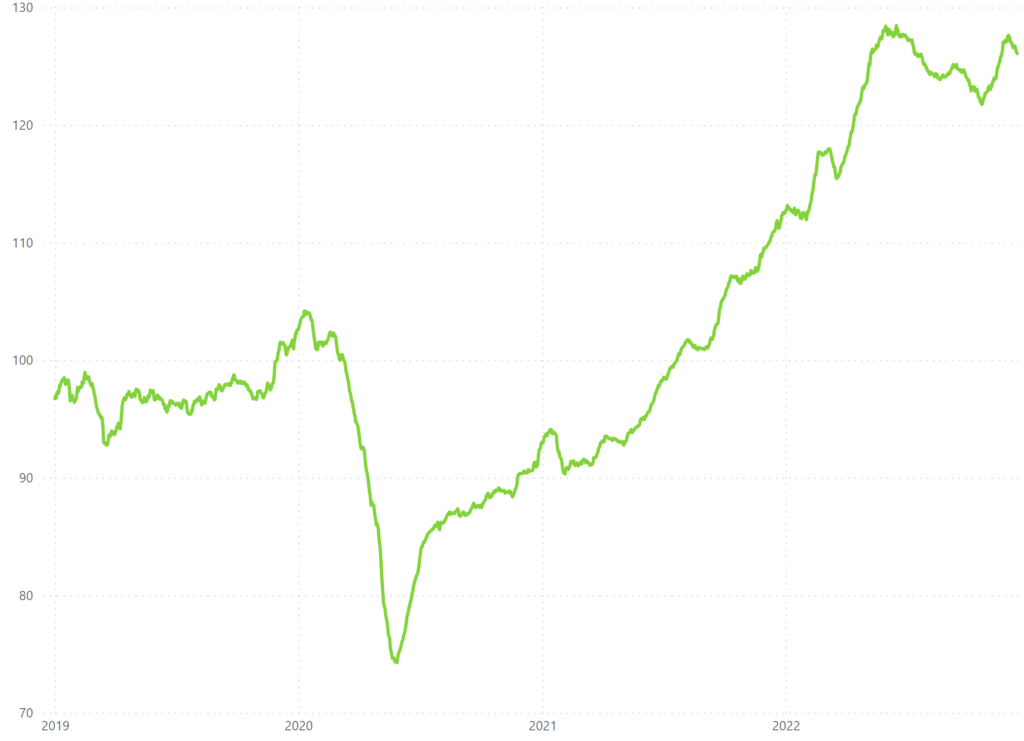

Avinode Pricing Index – US Domestics, rolling 28 days, jet aircraft

Avinode Pricing Index – IntraEuropean trips, rolling 28 days, jet aircraft

By now, every consumer from Germany to the US is aware that economic growth has slowed. For many countries, we are entering a recession. The good news for our industry is GDP contraction and business industry passenger numbers appear uncorrelated. As wealth inequality has grown, a buffering cushion of wealth protects our customers.

The great resignation, anyone?

We have also seen change forced on our industry in how we must do things. COVID remains with us. In the US, some estimates put the loss of available labor from deaths or long terms illness at over 1.6m people. The impact has been worldwide and felt in our industry. There is nothing like a pandemic followed by a tight labor market to leave many employees contemplating a change. Our industry has yet to escape this impact from pilots to ground staff; retaining and recruiting have proved challenging. Talent management is critical to successfully delivering for customers and shareholders.

As employees leave and expectations for how companies work and function change, companies have scrambled to adjust. Nowhere was this more visible than in early 2020, with many employers executing a rapid shift to Working from Home.

The application of technology to support business evaluation became paramount in solving existing business problems, improving customer delivery, the efficiency and reliability of operations, and limiting the impact of knowledge walking out of the door.

Coming from a technology company, you will not be surprised to hear me say this. However, this has been an equal learning opportunity for the Avinode Group.

Raising capital will be a new ball game

It is, unfortunately, not all positive news for our industry. We are a capital-intensive industry, and over the last 15 years, this has not been a challenge in an era of cheap money. The shocks to the global economy I noted at the beginning mean the cost of capital, measured in interest rates, is now at the highest since the Financial Crisis of 2008.

As interest charges rise, some operators and overleveraged companies may struggle. Commercial aviation may feel this hardest as any downturn in traffic triggered by recession and reductions in household spending will happen first. The euphoria of the 2022 rebound in pent-up leisure demand may be short-lived.

Similarly, raising money for business acquisitions or bringing new ideas into the market will be more challenging. We have already seen one aviation SPAC withdrawn from the market. Such conditions favor established players, and I can understand why some argue that we will see more consolidation. Equally, I can relate to those who may sigh relief that the years of competing against cheap capital may be closing.

Is business aviation immune to economic turbulence?

So where do I end up having not followed my advice about staring at the past? Firstly, we are fortunate to be entering any downturn in an industry with high immunity. Toilet paper and business jets may be at opposite ends of the spectrum, but they are both resistant to the thrills and spills of economic turbulence.

Secondly, the last years have alternated many expectations and preconceptions about how companies function for employees and customers. Companies that successfully manage talent and technology will start the next economic cycle in pole positions.

We may have further turbulence before the next economic upswing gains momentum, but as the world has learned in 2022, surprises will come in many forms. Those that adapt and lean into those surprises have the best chance of succeeding.