A sharp rise in price—but not in resistance

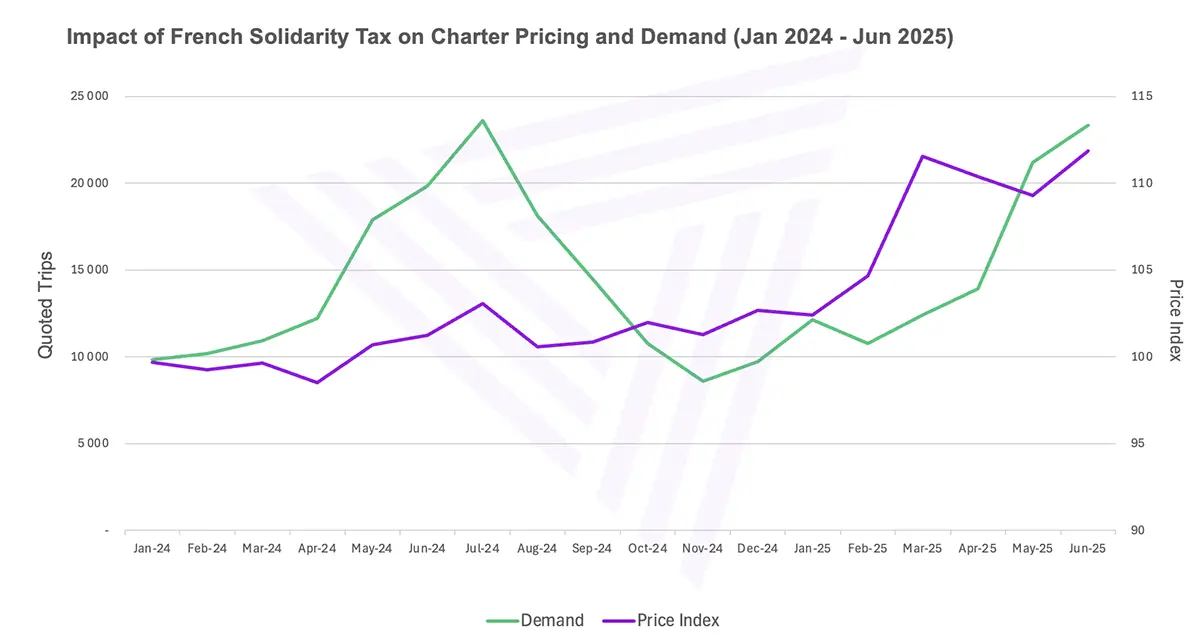

The French government’s new departure tax, rolled out on March 1, applied to private aviation passengers at rates ranging from a few hundred to over two thousand euros, depending on distance and aircraft type. Almost immediately, data from Avinode showed a sharp uptick in quoted prices for flights departing from France—up 9.2% in March and April. The cause was clear: the added cost of the tax was being passed through to customers.

That’s not surprising in itself. But what came next was. Despite the price increase, demand didn’t drop. The volume of trip requests for French departures held steady, and in short, there was no visible customer pushback.

The market’s reaction: steady as she goes

Harry Clarke, Head of Insight and Analytics at Avinode Group, explained what makes this significant: “You’d expect that when prices go up, demand goes down. But we didn’t see that in the French data. Quoted trips stayed consistent, even after a fairly sharp price rise. That suggests that private charter customers, at least in this context, are more resilient than we often think.”

Harry clarified that this doesn’t necessarily mean there won’t be a delayed impact, especially for leisure flights in this summer season. “It could be that people had already planned and budgeted their business trips. It’s also possible we’ll see down-gauging—fewer midsize jets, more light jets. But my take is that this shows a real degree of price inelasticity in this market.”

A price-driven market, or a value-driven one?

This conversation was also part of an Avinode Group-hosted panel discussion at EBACE 2024, where speakers reflected on broader pricing shifts across the market. Julie Black of Hunt & Palmer noted that rising costs are not limited to specific countries or taxes; they’ve become part of the charter pricing trend overall.

“Frankly, yes,” she said, when asked whether she was surprised by the ongoing rise in charter pricing. “If I look at some of my habitual customers who are doing the same trip year in, year out, they’re probably paying 40% more than five years ago—but they’re still flying.”

From Julie’s perspective as a broker, the issue isn’t whether clients notice the price; they do. But pricing alone doesn’t determine whether they book. “Passengers are definitely paying a higher price to get where they need to be,” she added. “Margins are harder to come by, but the demand is still there.”

This reinforces the idea that while cost matters, charter decisions are still shaped by flexibility, reliability, and service.

Don’t confuse private with commercial

Other panelists warned against applying commercial airline logic to private aviation. Yann Guillaume-Jaccard from Simply Jets was clear: “Anybody that says ‘I’m going to bring airline logic to this industry’—it’s really damaging. The moment you do that, clients stop treating private aviation as a service and start treating it as a commodity. And then price becomes the only factor.”

His point is that the value of a private charter is the nature of the service: flexibility, reliability, personalization, not just getting from A to B. If clients start comparing flights on price alone, operators lose the room to create value and protect their margins.

Too soon to say

The French Solidarity Tax offered a precise moment to observe price sensitivity in the market. While pricing had already been trending upward in recent years, this policy-driven increase provided a valuable test of how customers respond when costs rise for reasons beyond operators’ control.

So far, the market’s reaction has been clear: despite higher prices, demand remains firm—even into the summer peak. Whether that holds true beyond the busiest months is still an open question, but for now, private charter customers continue to prioritize access, flexibility, and service over price.